-

Sort By

-

Newest

-

Newest

-

Oldest

Elon Musk once famously claimed, “lithium batteries are the new oil”. Yet lithium-ion batteries merely trade the oil problem for a lithium problem.

ASX powers ahead, lower bond yields, records broken at Premier (ASX:PMV) The ASX200 (ASX:XJO) delivered once again, pushing higher with falling bond yields and a finally weakening currency, which is now under 76 US cents. The much-anticipated release of the economic Purchasing Manager Index or PMI results, which offer an indicator of spending and investment intentions, hit…

ASX finished 0.7% higher, Crown (ASX:CWN) under offer, Fortescue (ASX:FMG) tanks The ASX200 (ASX:XJO) overcame a weak global lead to break a three day losing streak, adding 0.7% on Monday. Every sector was higher barring materials, with Fortescue Metals (ASX:FMG) dragging the sector lower, falling 4.3% on a further weakening of the iron ore price. Energy was by far the highlight,…

Market weakens, CBA enters BNPL space, Corporate Travel sell down The ASX200 (ASX:XJO) fell 0.5% on Wednesday, following a confluence of global factors. It was a mixed day with six of the eleven key industry sectors falling but energy and materials remaining under pressure. The iron ore price has remained strong, however, both BHP Group (ASX:BHP) and Rio Tinto (ASX:RIO) fell as other commodity…

All Ords hit pre-pandemic high, ASX200 up 0.6%, Vocus (ASX:VOC) in play again The ASX200 (ASX:XJO) finished the week the same way it finished, adding 0.6% on Monday supported by a broad-based rally covering most sectors. Materials and discretionary retailers were the biggest beneficiaries of the risk-on mood, with BHP (ASX:BHP) and Wesfarmers Ltd (ASX:WES) finishing 2.4% and 1.0% higher respectively….

OK, so you want to own a big global diversified bulk miner, to take advantage of the impending commodities boom – let’s take a look at the contenders, BHP and Rio Tinto. Here’s the tale of the tape. BHP (BHP, $36.35)Market capitalisation: $183.7 billionOne-year total return: +6.9%Three-year total return: +17.9% a yearFive-year total return: +14.2%…

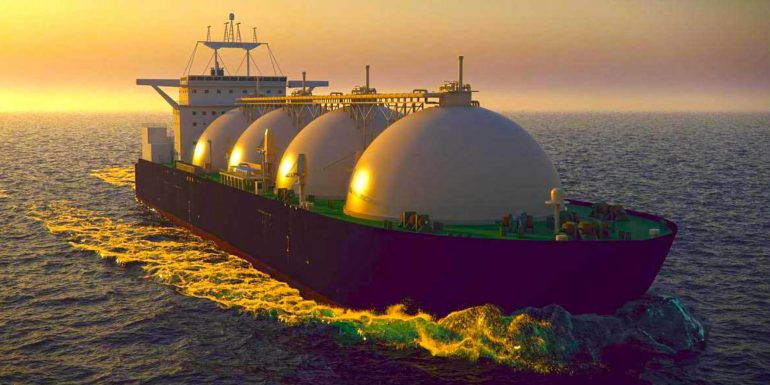

A focus on oil and gas abandonment and implications for the ASX.

In a sea of potential contrarian trades, oil is one that stands out. The North American West Texas Intermediate (WTI) benchmark has lost more than 75 per cent since the start of 2020, seeing it fall to its lowest price since 2002. The European Brent grade has dropped by almost 65 per cent. They are…