-

Sort By

-

Newest

-

Newest

-

Oldest

ASX shakes off sentiment, IT recovery, Charter Hall, Reliance deliver records The ASX200 (ASX: XJO) shook off a rare negative week to open 0.4% higher on Monday. The IT and property sectors, up 1.7 and 0.9% respectively were the key contributors as reporting season continued. Energy remains under pressure with Ampol (ASX: ALD) down 4.8% on a weaker earnings report and…

It hasn’t been a great year for the healthcare sector, whether due to company-specific issues or the pressure of a strong Aussie dollar holding back what are predominantly overseas profits. Overall, the healthcare index is up 9.7 per cent for the year, but that’s a far cry from the rest of the market. The S&P/ASX…

Bank rally not enough, Westpac hike dividend, job ads continue to surprise The ASX200 (ASX:XJO) rose just three points to begin the week, with a powerful day from the financials sector (+1.4%) which represents some 30% of the index not enough to overcome broader weakness. Energy and materials continue to detract amid signs that inflation is being…

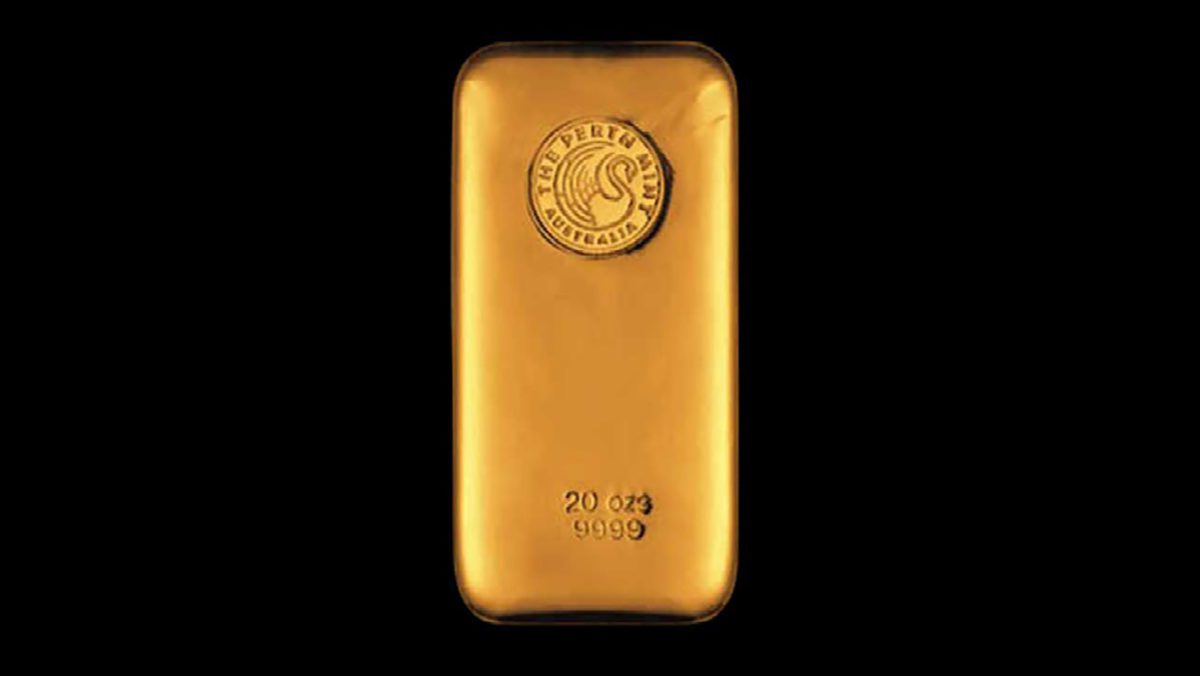

Lesson #1. Gold does well in crises, acting like portfolio insurance Every investor wants an asset that offers downside protection, or insurance of a sort. And preferably one that is not suspiciously complicated or synthetic. Perhaps the major lesson from the coronavirus is that gold can provide this type of insurance, as the yellow metal…

The February earnings season produced some of the best results in nearly a decade. The tough operating environment brought on by the pandemic is largely over and we are now at the beginning of an earnings recovery. The number of coronavirus cases reported from US nursing homes has fallen by more than 80%. The turnaround…

ASX200 0.4% higher, quiet day of news, Fortescue (ASX:FMG), Zip Co (ASX:Z1P) among the strongest The ASX200 (ASX:XJO) finished 0.4% higher on very light volume with most participants clearly opting for a long weekend. The consumer and IT sectors continued to outperform behind the likes of Zip Co (ASX:Z1P) and Kogan (ASX:KGN), which finished 2.6% and 3.8% higher respectively. Despite the…

With 2020 behind us, the first year of the pandemic is now history, but recent headlines suggest it is far from over. The virus continues to spread, intermittent lockdowns have become the norm and Australia will soon roll up its sleeves after securing 53.8m doses of the AstraZeneca and 10m doses of the Pfizer vaccines….

What drove markets in November? Markets delivered an early Christmas surprise with November’s market performance delivering one of the best months of the entire year. The ASX 200 Index posted a whopping +9.96% gain while the Small Ords rallied +10.20%. In the US, it was a similar story with the S&P 500 Index posting its…

One of the stocks most hammered by the COVID correction in February-March was Qantas, which plummeted from $6.67 to $2.14, a fall of 68%, as the effect of the pandemic on air travel began to sink-in to the market. Like most of its peers, Qantas found itself in “the most challenging period in its long…

And just like that, pharmaceutical behemoth Pfizer (NYSE:PFE) seemingly comes through with the goods, announcing a 90% effective COVID-19 vaccine. Global markets rejoiced, punching the air in delight screaming ‘pandemic over’. First Joe Biden is elected, the US rejoices in happiness, and now this. It could not get any better. As Bob Marley would say,…