-

Sort By

-

Newest

-

Newest

-

Oldest

Australian women are, on average, investing more of their income into sharemarkets, and overwhelming focused on using their capital to back more ‘ESG friendly’ investments. These were among the key conclusions of Pearler, an investing app that seeks to both educate and build a community around finances and investing.

Fast fashion jewellery shouldn’t be a lucrative market. Yet Lovisa Holdings Ltd has grown sales by 30% per annum for the past decade, with its store count increasing 12-fold. Over 70% of its outlets now reside outside Australia, with an ambitious plan to take its success across Europe and North America.

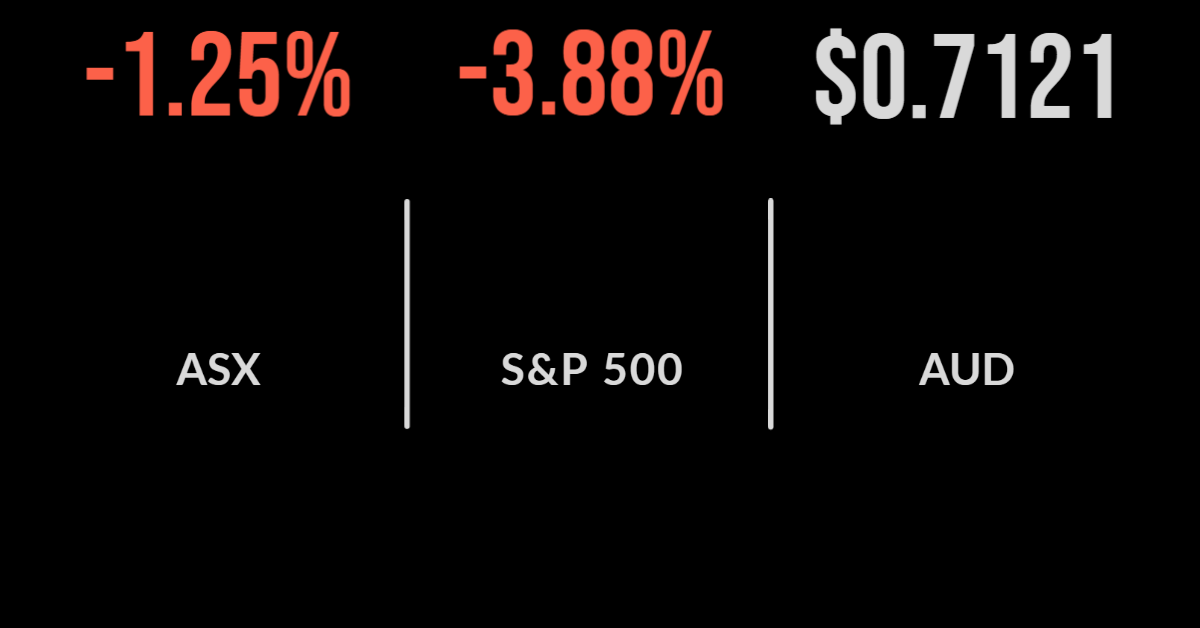

Anyone keeping up with the news overnight is aware of the headlines. $88 billion lost in a single day, market crumbles, stocks tank; there will be no lack of hyperbole following the worst day for the S&P/ASX200 since March 2020. The market fell by close to 5 per cent during the session, following a rough…

The local market was pushed lower by the global turnaround in interest rates with the S&P/ASX200 falling 1.3 per cent to finish the week. Every sector was lower, led by property, which fell 2.9 per cent on concerns that higher interest rates will hit valuations, while another six sectors dropped more than 1 per cent,…

The struggles of the big banks and mortgage lenders in the wake of this week’s rate rise continued on Thursday, with the financials sub-index losing 2.2 per cent and helping to drag the benchmark S&P/ASX200 index 101.4 points, or 1.4 per cent lower, to an almost four-week low of 7019.7. The broader S&P/ASX All Ordinaries fell 106.6 points, or…

Yellow glow on ASX Resources came to the rescue on the Australian share market on Wednesday, with surging uranium and oil and gas stocks more than compensating for a shocker from the banks. A call from Goldman Sachs that Brent crude would average US$140 a barrel between July and September, up 17 per cent from its prevailing…

Fund managers were among the top performers of the day, with Magellan gaining 2.1 percent. Here are three Buys that the brokers are confident will outperform.

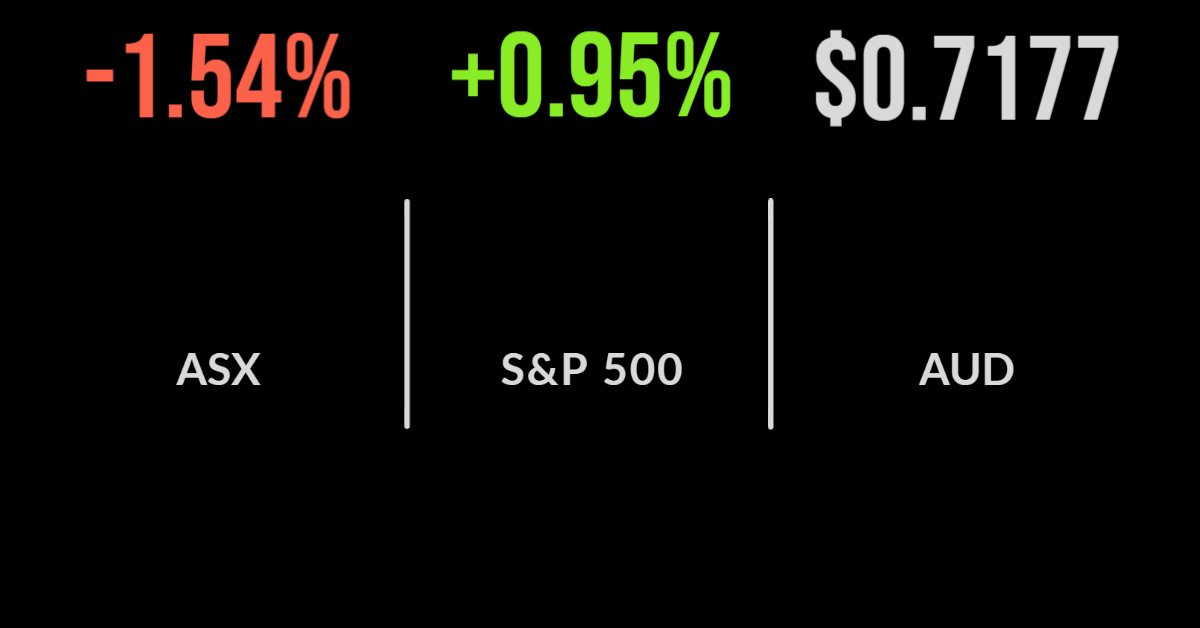

The Australian sharemarket was on hold ahead of the RBA’s latest board meeting and interest rate decision. A somewhat unexpected 0.50 per cent increase in the cash rate to 0.85 per cent saw the S&P/ASX200 slump by 1.5 per cent. The large move was predicted by only a few experts with the RBA highlighted the fact that inflation had…

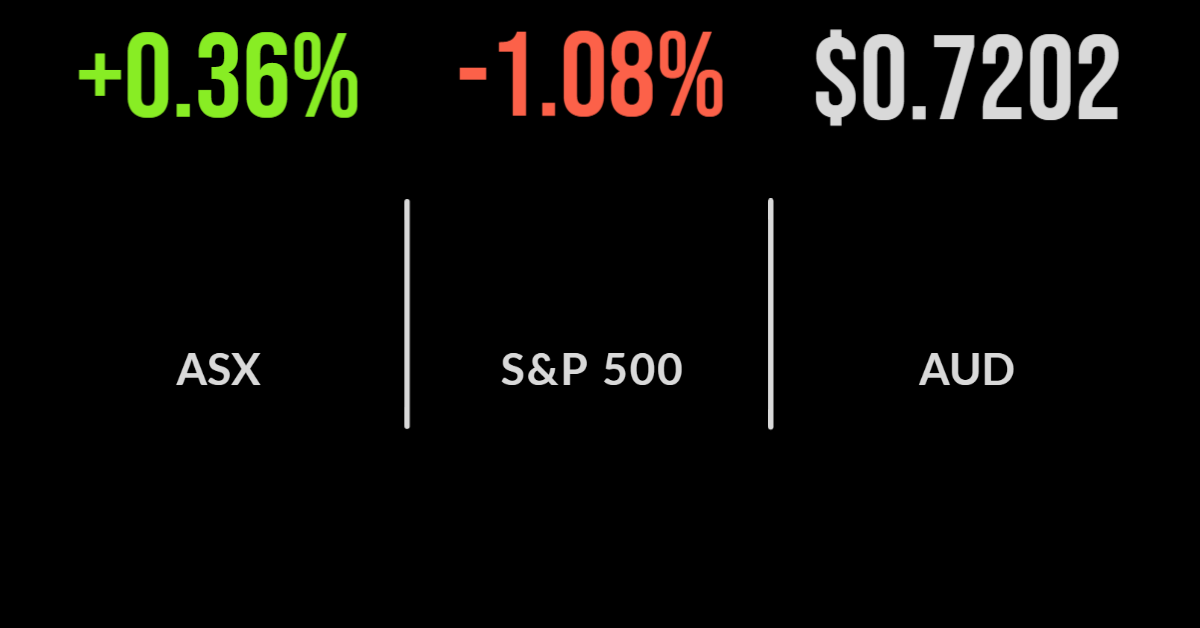

Both the Australian and US markets have seen a modest rebound towards the end of the week, however, it’s a little too early to say whether the sell-off is over. This week brokers have issued a series of upgrades and Buy recommendations.

After decades in the industry there are a few key characteristics that tend to stand-out and are best to look out for when assessing these new and emerging opportunities.