-

Sort By

-

Newest

-

Newest

-

Oldest

Most readers will own unlisted assets via their superannuation fund. Here we provide an overview and break down the advantages and downfalls of investing in the asset class.

The country’s largest super fund, Australian Super, has announced a new fee structure aimed at reducing member costs by $300 million this year, following what has been a busy year for consolidation in the industry.

With less than a month remaining, EOFY is fast approaching and for financial advisers, it’s the most stressful time of the year. In under a month, things can turn from calm to overwhelming, at the blink of an eye.

Marius Wentzel, Head of Client Solutions & Distribution at AMP and Graeme Colley, Executive Manager, SMSF Technical and Private Wealth from SuperConcepts delivered an insightful presentation this week, offering an update on the macroeconomic outlook and an EOFY checklist for SMSF trustees. Disruption caused from COVID-19 to local economy and the fast-approaching financial year end,…

The end of the financial year is closing in fast after what has been a tumultuous period for many in Australia. Despite a reasonably uneventful year for superannuation legislation and policy changes, opportunities abound for superannuants and investors of all kinds. One of the most important roles of a financial adviser is to prompt and…

Magellan Financial Group (ASX: MFG) this week released its long-awaited new retirement product called FuturePay. It comes at an important time for the investment and superannuation industry in general, which has seen very little innovation or new product releases focused on delivering more sustainable retirement incomes. So, what is Magellan FuturePay? The product seeks to…

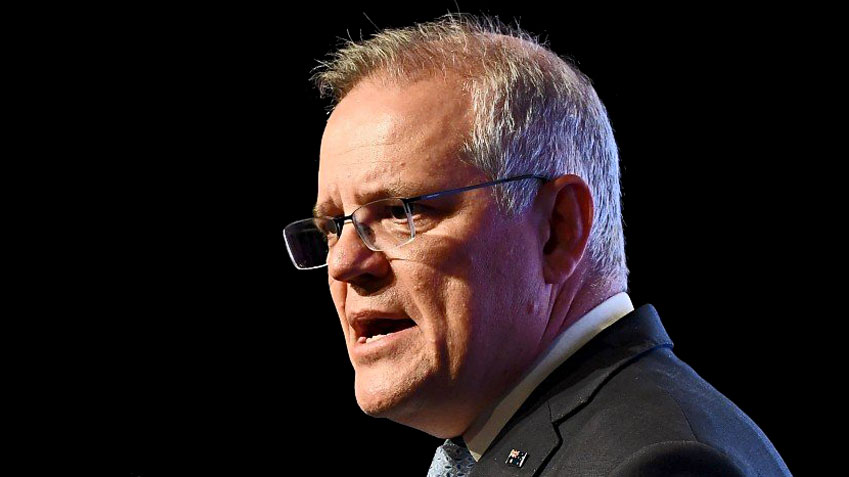

Prime Minister Scott Morrison took the opportunity at this week’s Liberal Party Meeting to confirm that the minimum pension drawdown standards would be reduced for another financial year. The so-called COVID-19 measures were set to apply for the 2019-20 and 2020-21 financial years in light of the ‘financial losses’ experienced by investors during the pandemic….

While all the headlines are dedicated to the ballooning budget deficit, tax cuts and a departure from the traditional “balance the budget” approach of the Coalition, there were a number of positive takeaways for both older and younger Australians. The announcements have increased the flexibility and attractiveness of both the superannuation and self-managed super fund…

Raiz Invest (ASX: RZI) – The micro-investing app has announced its active customer numbers and its funds under management (FUM) statistics for the month to 30 April. The group is continuing to see strong growth as retail investors flock to the market. The app continues to grow exponentially, up 96% over the last 12…

As the industry fund sector embarks on what will be a busy and decade shaping year, Rainmaker’s recent release of its latest batch of AAA-rated super funds couldn’t be more timely. The research house seeks to assess the quality of 692 products issued by 178 superannuation funds including both industry (or so-called ‘not for profit’)…