-

Sort By

-

Newest

-

Newest

-

Oldest

The first quarter of 2024-25 saw the largest supermarket player grow its sales. This positive result was more than offset by a combination of regulatory and political factors, higher operating costs and growing competition from Amazon.

Sustainable investing requires a balancing act when it comes to retail behemoths like Coles and Woolworths, which can have positive ESG policies while selling products with the potential to do harm. According to Australian Ethical, investors should assess these companies with nuance and a measure of compromise.

Thing are looking up for retailers, and especially groceries providers, as higher prices drive profits. But the roads won’t be paved with gold to Woolies and Coles forever.

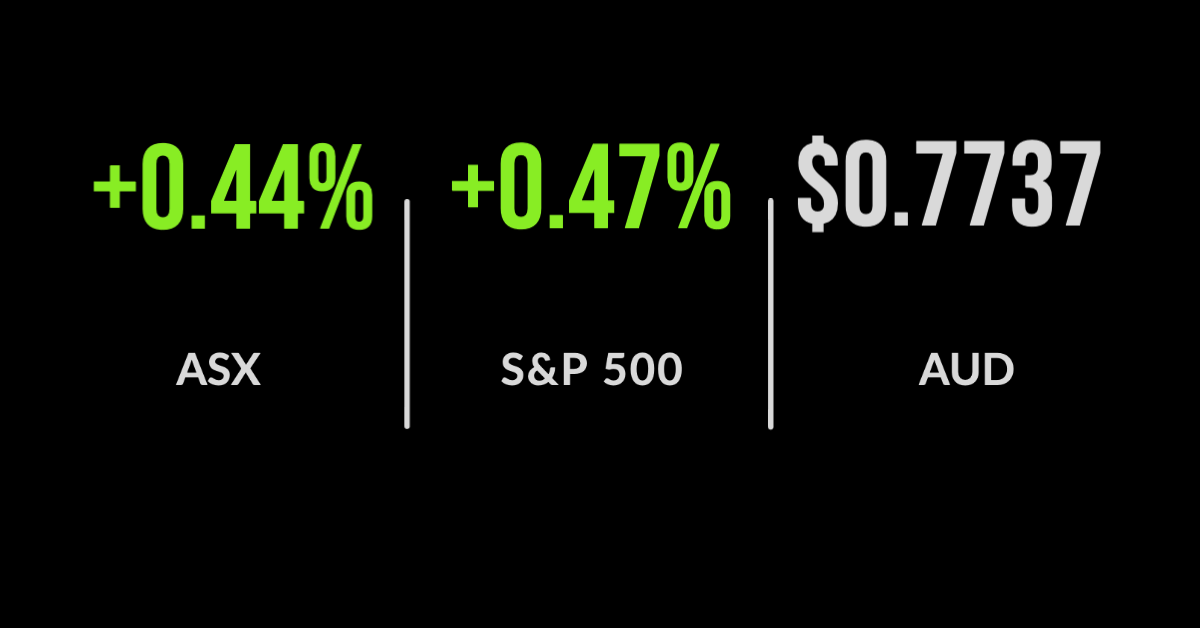

Reporting season sends ASX lower, Appen, A2M tank, Woolworth’s surprise buyback The ASX200 (ASX: XJO) pushed lower on Thursday as the reporting season losers outweighed the winners. All eyes were on the consumer sectors with staples falling 0.8% and discretionary adding 0.3% as Woolworth’s (ASX: WOW) delivered a strong result. Two midcaps popular with brokers and DIY investors alike…

Last Thursday, Endeavour Group Ltd (ASX: EDV) completed its first day trading on the Australian Stock Exchange (ASX) as a public company. The share price closed at $6.02. EDV has since got a move on, rising to $6.39 (it reached $6.55 on Friday) Endeavour encompasses the liquor stores, hotels, hospitality venues and gaming assets formerly under the control of Woolworths Group Ltd (ASX: WOW)….

ASX falls as Afterpay spikes, Woolworths’ spin-off, retailers rally The ASX 200 (ASX: XJO) fell 0.3%, the second straight day of losses, with consumer staples (+1.9%) and IT (+2.1%) the only real winners. The majority of the selling pressure came from healthcare and energy, falling 1.8% and 1.2% respectively, with continued weakness in CSL Limited (ASX: CSL) dragging the…

ASX moves higher, as every sector but energy improves, Woolworths’ takeover to go ahead The ASX 200 (ASX: XJO) capped off another positive day on Thursday despite a fall in the oil price sending the entire sector down 1.1%. Every other sector was higher, barring materials, which finished flat, with real estate and IT once again leading…

In this article, I’ve provided a short update on a number of widely held and strong ‘blue-chip’ businesses following the recent reporting season. Commonwealth Bank (ASX:CBA) lead the earnings reports today, with all eyes on the dividend management delivered $1.50 per share. That represents a 53% increase on the small 2020 dividend but 25% down…

The Australian reporting season stepped up another gear this week, dividends and cost cutting were the most important topics on the agenda. The threat of inflation is also clearly increasing, with government bond yields in both the US and Australia hitting 12-month highs. Despite this investors remain resilient and unconcerned about the risk of an…

Focusing on three sectors of Australian shares for direct purchases, sectors favoured by SMSF trustees and other individual investors, Morningstar offered its top picks at the annual Morningstar Investment Conference last week (October 8-9). Cognisant of market volatility, valuations, dividend policies and the importance of fundamentals in uncertain times, three Morningstar researchers – Johannes Faul,…