Tech surge lifts ASX to fifth straight week of gains

Fifth straight weekly gain, tech back in favour, commodities tank, AUD weakens

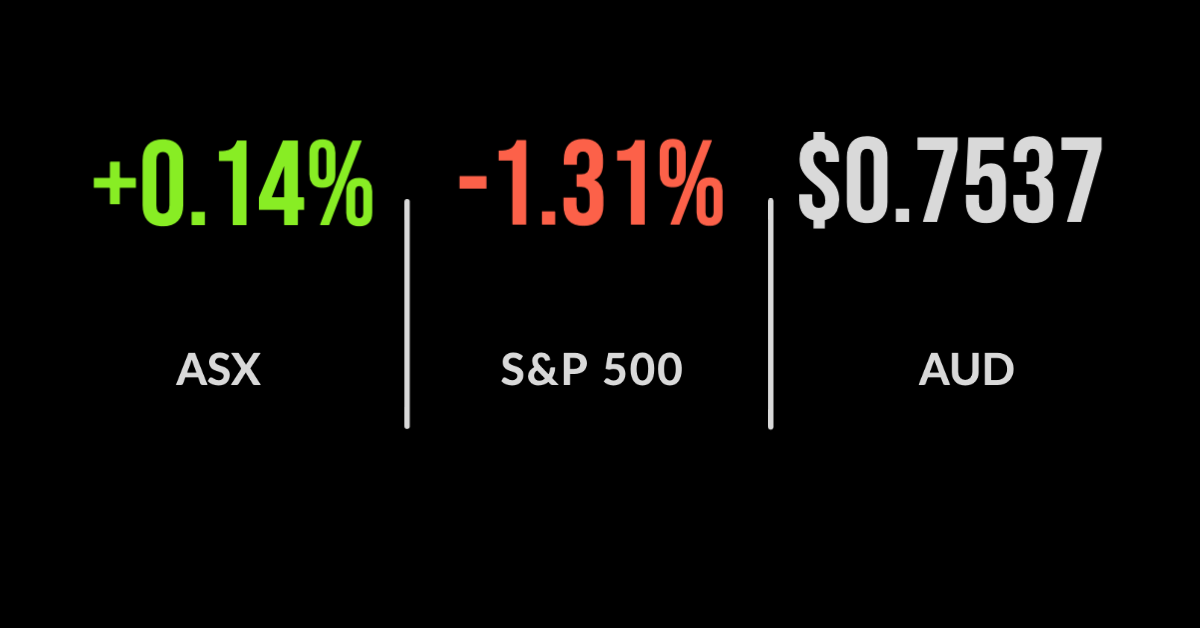

The ASX 200 (ASX: XJO) finished 0.1% higher on Friday as markets continued to digest this week’s change of heart from the Federal Reserve.

The IT sector overcame valuation concerns to jump 3.5% higher on Friday and 6.1% over the week.

Leading the market was Afterpay (ASX: APT) and Zip Co (ASX: Z1P) which finished 6.5% and 9.9% higher during the session and 18.5% and 14.6% higher over the week.

Commodities were the biggest detractors, down 2.9%, as the increased probability of rate hikes saw the USD strengthen.

Copper producers including OZ Minerals Limited (ASX: OZL), down 10.8% for the week, were among the hardest hit after the Chinese government flagged concerns about prices getting out of control.

Woolworths Group Ltd (ASX: WOW) dropped 1.6% on a busy day for the company with the Fair Work Commission announcing an investigation into their underpayments and shareholders resoundingly approving the demerger of the Endeavour Drinks Group.

The healthcare sector jumped 4.5% over the week, with the predominantly globally facing companies like CSL Limited (ASX: CSL) and Resmed (ASX: RMD) benefitting from an AUD that fell to its lowest level this year.

US markets deliver worst week in four months, reopening trade closes, tech outperforms

US markets ended the week on a negative note, with the value-focused Dow Jones falling 1.6% on Friday and 3.5% for the week.

The S&P 500 fared slightly better, down 1.3% and 1.9% respectively with the big tech names outperforming once again.

This delivered a near flat result, down 0.3% for the Nasdaq as the reverse recovery trade commenced once again.

In an about-face to the hugely popular commodities, vaccine, and general ‘value’ recovery, investors are once again focusing on growth with the likes of Netflix, DocuSign, and PayPal all outperforming during the sell-off.

The fading of US fiscal stimulus and a more aggressive tone from Federal Reserve member James Bullard, who expects rates to be hiked even sooner, were blamed.

However, an event known as the ‘quadruple witching’ also occurs on the 18th of June, a day where nearly every major option expires, requiring those speculating on price moves to deliver their agreed shares.

Hence a portion of the selling pressure was likely due to this confluence of events after another busy quarter.

Rate hikes still years away, growth is what matters, unemployment hides immigration risk

All eyes were on the Federal Reserve this week and they certainly delivered, announcing that the majority of board members now expect the cash rate to be increased in 2023.

Yep, 2023 is when they expect rates to increase, but once again there was no action at this meeting.

Despite headline after headline of inflation and the threat of rate hikes leading to a massive sell-off in equities, they delivered positive returns across the board.

Of most interest, however, was the fact that the world’s biggest technology names, including Apple, Facebook, and the like actually performed well.

Many had expected the tech sector to sell off as higher bond rates suggest current valuations can’t be sustained, but this was likely a reminder that growth is all that matters, and no fixed rules apply in the markets of 2021.

Going further, most managers have been rotating to ‘reopening winners’ but particularly commodities on the expectation that an economic recovery would see another super cycle.

Yet the Federal Reserve’s announcement actually sent the US Dollar sharply higher, hitting commodity demand.

Finally, this week saw unemployment fall to 5.1%, or the same level it was prior to the pandemic, a stunning result.

Yet as Christopher Joye of Coolabah Capital points out, it actually hides some 330,000 jobs previously held by non-residents and may overstate the result by as much as 2%.