Trump presidency raises BHP’s risk profile for shareholders

The mining industry is always captive, to a greater or lesser degree, to geopolitical tensions, but the ascendency of Donald Trump to the White House for a second term in office from January 20 clearly magnifies the risk.

Even before assuming office, Trump has sent tremors through the capitals of allies and foes alike, as well as boardrooms, with his threats to impose tariffs across the board.

For BHP (ASX:BHP), the next four years will be a delicate balancing act to keep a Trump administration onside while defending its commercial interests, especially with its biggest customer – China.

That BHP – its share price has fallen 12.7 per cent in the past year to close at $40.66 on Tuesday – realises the stakes are high is symbolised by the recent appointment of former NSW Premier Dominic Perrottet as its US government and external affairs liaison officer in Washington. At the same time, it must remain finely attuned to how Beijing will respond to a Trump presidency.

As the board and executive team ponder strategy, they can do so from a position of relative strength, based on BHP’s recent updates on financial performance, major projects and a landmark settlement related to the Samarco dam failure in Brazil. It has also continued its policy of keeping shareholders onside by delivering a healthy dividend stream.

For the financial year to June 30, 2024, the company delivered a $US7.4 billion ($11.4 billion) payout to shareholders. With consistent cash flow and disciplined capital allocation, BHP has distributed more than $US50 billion ($77.2 billion) in dividends over the past five years, solidifying its position as a leading mining dividend payer.

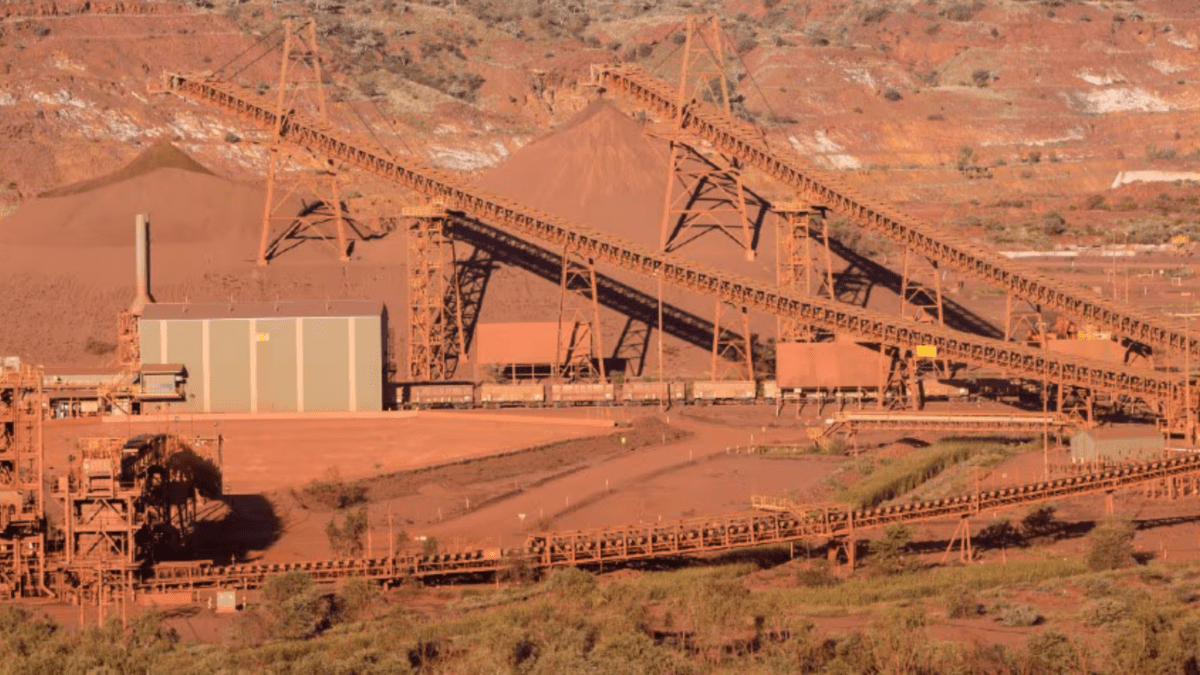

The operational review for the first quarter of the 2024-25 financial year highlighted a four per cent increase in copper production and three per cent rise in Western Australian iron ore output, driven by operational efficiencies and infrastructure upgrades. These figures underpin BHP’s ability to meet production guidance and maintain strong cash flow.

A key development for shareholders was the resolution of legal claims surrounding the 2015 Samarco dam failure in Brazil. On November 6, 2024, the Brazilian Supreme Court ratified a $US31.7 billion ($49 billion) settlement agreement between Samarco, its shareholders (BHP Brasil and Vale S.A.), and Brazilian authorities.

This agreement closes multiple claims while committing to environmental and social reparations for the affected communities. For shareholders, the settlement offers financial clarity and ensures BHP can focus on future growth.

Looking to the longer term, BHP is emphasising the aligning of its portfolio with global mega trends such as decarbonisation, urbanisation and food security, positioning the company to enhance shareholder value.

Significant progress in key projects include increased copper production at Escondida in northern Chile, up 11 per cent in the first quarter of 2024-25, driven by higher grades and efficiency improvements. BHP also announced a joint venture with the Canadian group Lundin Mining to advance copper projects in Argentina and Chile, responding to an anticipated 70 per cent rise in copper demand by 2050 due to electrification and digital infrastructure.

The Jansen potash project in Canada is now 58 per cent complete, with the first production expected in two years. Potash, essential for sustainable agriculture, is a cornerstone of BHP’s diversification strategy. The wildcard for this project is Trump’s threat to impose a 25 per cent tariff on Canadian exports.

Production of steelmaking coal rose 20 per cent compared with the previous quarter (excluding divested mines), driven by operational improvements. The company remains focused on high-quality coal critical for infrastructure and green energy transitions.

BHP continues to navigate a volatile global environment marked by geopolitical instability, inflationary pressures and uneven economic recoveries. Despite these challenges, the company has demonstrated operational agility, such as suspending its Nickel West operations to preserve optionality for future market conditions.

But the biggest question mark remains China. Will Beijing’s fiscal stimulus plans, including debt relief and property market stabilisation, drive demand for BHP’s products? While the company remains cautiously optimistic about these developments and their potential to support global growth, doubts must remain, especially with Trump in the White House.

But BHP’s proven ability to deliver consistent returns, even in challenging environments, underscores its resilience and strategic foresight. For shareholders, the steady dividend flow is an added bonus.