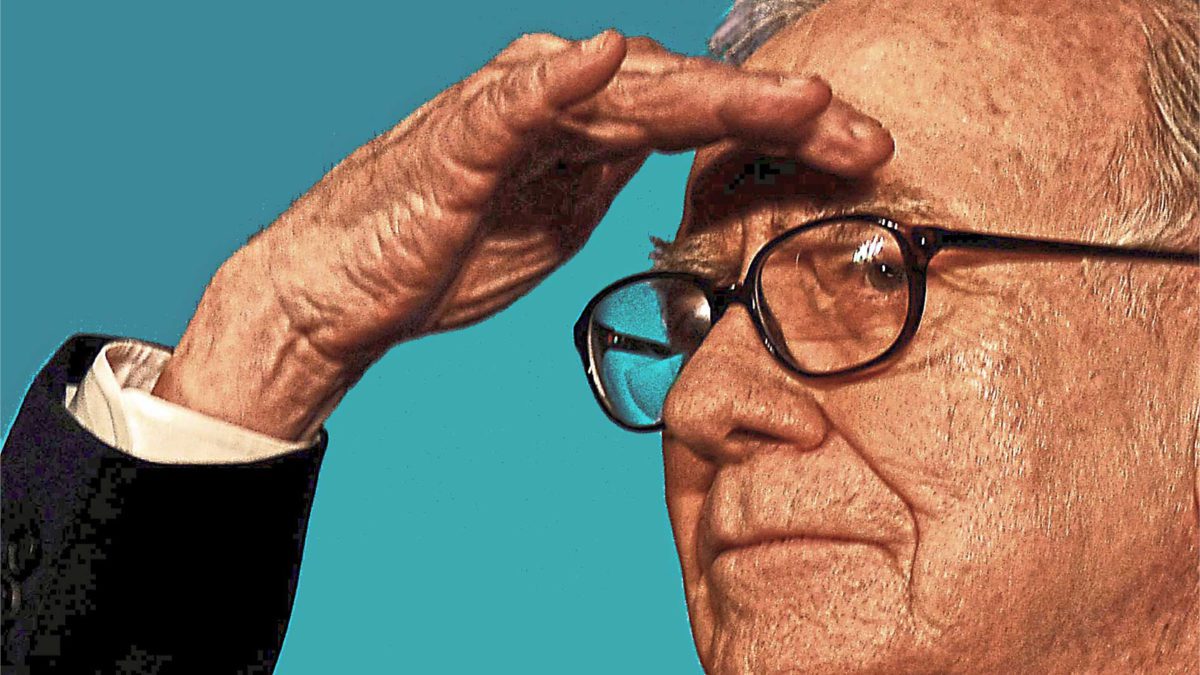

What has Buffett been up to now?

The most-quoted man in finance, Warren Buffett, recently released the quarterly update of portfolio holdings for the US$570 billion ($730 billion) Berkshire Hathaway conglomerate. There is little doubt that Berkshire (NYSE: BRK.A) was incredibly busy during the final quarter of 2020.

Most interesting was the decision of management to request that the US Securities and Exchange Commission (SEC) keep a number of new investments it made in the December quarter secret. According to experts, the SEC is able to grant confidential status if it agrees that disclosure would move the stock price of the purchased company.

While commonly used by hedge funds and similarly aggressive investors, Buffett hadn’t requested the exemption since 2015, leaving investors and Buffett trackers alike waiting with bated breath on the news.

After a difficult beginning to the pandemic, coming after a rare period of underperformance, Berkshire has recovered strongly into 2021, with the vaccine pushing the three-sector portfolio higher. According to previous filings, the group separates equity holdings into banks, insurance and finance, consumer products, and both commercial and industrial businesses.

So what were the latest purchases?

According to the latest filing, the company has established significant positions in three companies spanning these sectors. The first is Verizon Communications, the second Chevron and the third Marsh and McLennan.

Verizon (NYSE:VZ) would be well-known to anyone who has travelled to the United States, being the second largest mobile network in the US and boasting a US$220 billion ($282 billion) market capitalisation. The company offers a direct exposure to the growing 5G and connectivity theme that has been accelerated by the pandemic.

Chevron would also be well-known, as a major global energy company, boasting a US$180 billion ($230.7 billion) market cap and a yield of over 5%. We know that Buffett loves a monopoly – or at least a major player in a volatile sector – with Chevron clearly fitting that bill. The company has recovered from the doldrums of 2020 when oil prices turned negative, with pressure growing on a move to more renewable energy generation.

Marsh & McLennan was the other major purchase, a little known US$58 billion ($74.4 billion) insurance, reinsurance and risk management business. Berkshire has a long and profitable history operating in the reinsurance sector, seemingly leading the world in this space, with the investment a further consolidation of its position. The company also owns the Mercer consulting business, which many Australian investors may know well via its administration services.

In an interesting move, the company also reported the sale of a holding in Barrick Gold, one of the world’s largest gold miners.

For someone that is a strong advocate for passive investing, Buffet is a very active and committed investor.